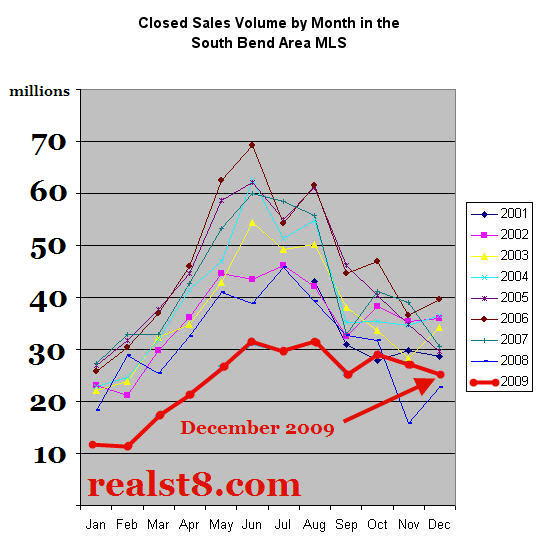

The South Bend Area MLS contains information on 234 sales that closed in December 2009 with a cumulative volume of $25.04 million. That is down from last months $27.48 million in sales, though up from December 2008’s $22.61 million in sales which was the lowest amount since our area’s MLS began keeping digital records in August 2001. The high volume mark was June of 2006 at $69.30 million.

Here is the long term sales graph:

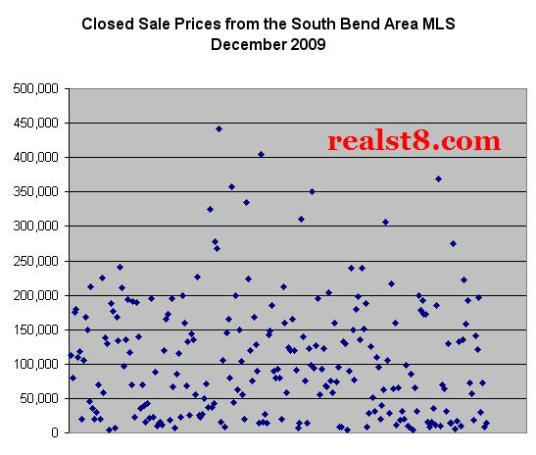

Sales Prices

The high price sale was $440,900 for 125 Esther in South Bend. The home went under contract 11 days after hitting the market and sold without photos in the MLS.

The low price sale was $3,800 for 230 Calvert in South Bend, which went under contract about five months after hitting the market and sold with just one poor quality photo in the MLS. I won’t post it here.

There were a number of sales that caught my eye as notable discounts:

- 51345 Amesbury Way in Covington Shores sold for $419,000 about six months after hitting the market. It sold at a loss to the seller, who appears to have paid $500,000 for the home in July 2007.

- 1904 Golfview Court in Barrington Estates sold for $335,000 about 28 months after hitting the market in August 2007. The seller started with a list price of $635,000.

- 51245 Parisian Drive in Bradford Shores was a recent “lottery house” that was raffled off for charity. The winner sold it for $275,000 about seven months after hitting the market at $375,000.

- 420 Abbey in Dublin Village sold out of foreclosure for $180,000 about three months after hitting the market at $199,900. The previous owners tried to sell it without success, starting at$244,900 and lowering their price to $234,900 .

Here are all 234 sales prices, in represented visually on a scatter graph

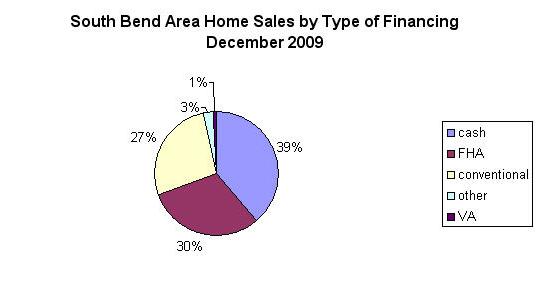

Financing

Cash sales accounted for more transactions than either FHA financing or conventional loans and they dominate the market under $50,000. 70 of the 76 sales under $50,000 were cash purchases.

Condos, Townhouses and Select Villas

This was not an active month for sellers of condos and townhomes in our area. Just one Notre Dame Area townhouse sold at Dublin Village.

420 Abbey in Dublin Village is a 1,745 square foot, 3 bedroom, 3.5 bath townhouse. It was built in 2006 by the same construction company now erecting many of the new townhomes near Notre Dame. Its price of $180,000 was well below the $214,900 to $265,000 list prices of the six Dublin Village townhomes currently listed for sale.

145 Bridgewater Way, a 1,450 square foot 2 bedroom, 2.5 bath condo sold in The Forest for $128,000. That is down from the $158,500 it sold for in August 2005.

Unit 312 at Topsfield, a 1,000 square foot 2 bedroom, 1 bath condo, sold for $51,000.

1522 Peachtree Lane in Mishawaka’s Savannah Pass is a detached villa but is in a community with many attached unit and seems to fit here. The 1,112 square foot, 3 bedroom, 2 bath villa sold for $123,900 down from the $145,000 it commanded in September 2006

There were two other condo-type sales in developments I don’t usually report in detail here. One was in the Somers Square condos, for $122,000, and one at the Jefferson Square townhomes for $74,000.

New Construction

18 December 2009 sales were reported in the South Bend Area MLS as new construction. They closed at prices from $99,000 to $324,305 and ranged from about $74 to $151 per square foot.

11 were built by Weiss Homes. 9 were sold with FHA financing.

Have Questions? Need Help?

While this is the most detailed and most current information you’ll find on real estate sales in the South Bend Area, there are significant details we can’t share here. If you need to better understand the market to make smart decisions, or need help buying or selling property call or e-mail. We’d be pleased to hear from you.

Thanks Nick!!! I think the market is stabilizing overall in Michiana. More downward price pressures for 2010 will lower dollar sales in 2010 compared to 2007 and beforehand and compared to the first half of 2008 too. The total number of sales (not by dollar amounts but by units) should improve in 2010 compared to 2009, especially in the first half of the year but might not be until spring. I would hazard to guess that the total sales volume in 2010 will be close to 2008 when totaled but will still be about 15% below overall (more than 15% below in first half and getting above in later half). The extra vacation home market will remain anemic.

2010 will be the year where home price and market denials will be gone and sellers and banks start to move inventory by lowering prices as the prospect of holding costs add up. Foreclosures will be more common as owners give up and REO sales (and short sales) compete with ordinary home sellers as banks look to get rid of their real estate assets.

The downtown Mishawaka mixed use project will be interesting to watch….a GREAT project but hitting the market at a time when enthusiasm for real estate is at a low…a pity really. Notre Dame related housing construction will remain well oversupplied as the “investment” component of owning an extra vacation home remains negative at best. New home builders will continue to rely on government backing for tax credits and government backed mortgages…they really should just stop building but the government will continue to beat itself over the head by subsidizing new construction which will only drag out the tortuously long price declines and delay market clearing.

Two questions for you NIck:

(1) Any update on Eddy Street Commons, esp. sales? It is hard to guess, but I think sales aren’t going to be vigorous at all.

(2) How many homes did Weiss Homes sell according to the mls? They are the largest home builder in the area but the construction quality is buyer beware in my opinion.

Eddy Commons is close to opening a model unit for their Champion’s Way townhomes. I expect to tour it next week and should be able to get an update on their sales at that time.

I found 55 sales in 2009 that are new construction with Weiss Homes as the owner. The sales prices were reported as $122,990 to $278,442 and came to $75.30 to $147.20 per square foot. 30 were purchased with FHA financing, 22 with conventional financing, 2 using VA loans, and 1 was a cash sale.

I’m surprised that “cream puff” on Chapin St is still available!!!!