The South Bend Area MLS records show that in September 2010:

- 220 residential properties were sold

- 176 residential properties went under contract

-

406 residential properties were newly listed or re-listed for sale (that is not a count of all homes for sale, just those listed in August. There are 2,295 homes listed for sale in the SB MLS as I write this)

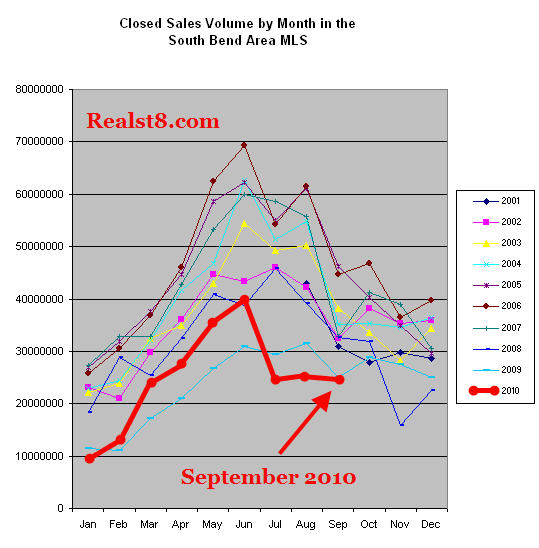

Those 220 sales add up to $24.98 million in volume. That is about 1.4% higher than in August 2010 and about the same as September 2009.

Here is the long term graph

Real Estate Sales Prices

The high price sale for September 2010 was 104 Conestoga in South Bend off Jefferson Road. It sold for $775,000 on 9/7/10. It was originally listed for $850,000 on 2/18/2010.

Other high price sales were:

- 51820 Harborough Drive in Granger’s Covington Shores for $550,000. It was listed for $665,000 on 9/23/2009 and previously sold for $617,000 in January 2009 and $610,000 in November 2007.

- 18263 Berger Street near Notre Dame in South Bend for $482,500. It was listed for $559,000 on 4/19/2010.

- 3230 Topsfield in South Bend’s Deer Run for $450,000. It was listed for $1.25 million on 3/9/2007 and previously sold for $850,000 in September 2006.

- 15852 Ashville Lane in Granger’s Quail Ridge South for $449,000. It was listed for $479,900 on 5/17/2010 and previously sold for $462,500.

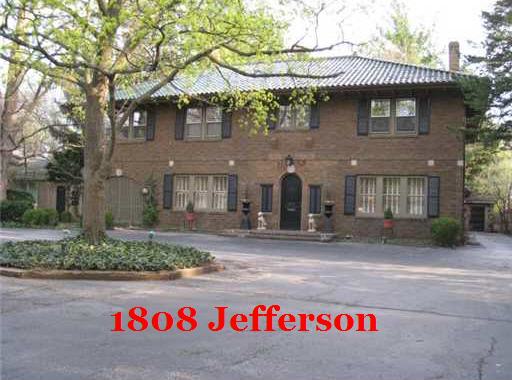

- 1808 Jefferon Road in South Bend for $425,000. It was listed for $650,000 on 4/8/2010.

There were 11 sales below $10,000 and 84 sales below $50,000.

Here are all the sales prices at a glance:

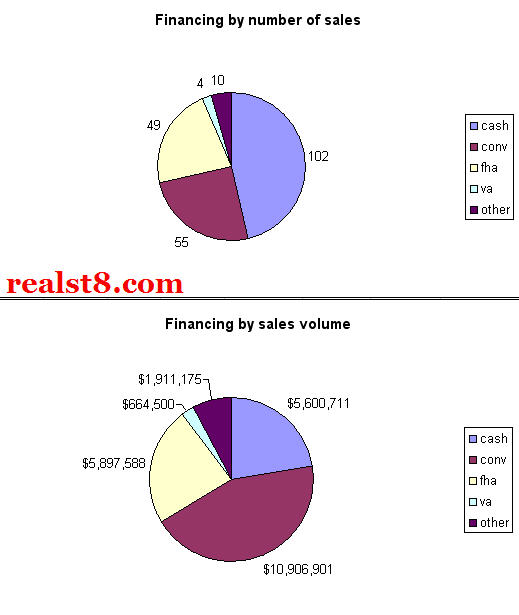

Financing

Cash sales account for the greatest number of September’s sales and conventional mortgages made up the largest portion of sales by volume. VA and other types of financing, such as lease-option and owner financing, remain comparatively rare by the numbers.

More Questions?

If you are considering the purchase or sale of property in the South Bend – Mishawaka – Granger – Notre Dame Area and want a no-pressure, no-hassles consultation with the Realtors behind the South bend Area Real Estate Blog, please contact us. We’re friendly and candid and if we can’t help you, we can probably point you in the right direction. Also, watch for more details on sales in niche markets like Notre Dame condos and new construction homes in coming posts, or feel free to ask questions in the comments. We can’t always answer them immediately, but do read them and try to incorporate them in future posts.

Sales still seem to be depressed. What will the winter bring? Any indication?

The 3230 Topsfield transactions seem to smack of funny business or someone way overpaid or someone got one heck of a deal for sure.

Two months without ND area sales info or new home sales info…….please. For me, these two things are good indicators of the area’s economic situation and so are always appreciated. Additionally, how is Oak Hill doing…post your “Is Oak Hill a bubble” post years ago (you were right!).

How is October sales looking???

Here’s to hoping that the New Year pulls everyone out of their funk. We are dealing with the same kind of numbers.

Very helpful information. Any updates?

Has there been any new home construction in Granger?

Any plans to update the blog?

Helllllllooooooo, hello, hello, hello…anyone there? LOL

Just checking in. Can’t wait to see the October and November numbers…..please. 🙂

I noticed that on the Ivy Quad website they are starting Phase II. Good for them! Looks like they are taking my (probably obvious) advice and Phase II will be all Clares…the small flats. Makes sense. Will they then be 3 story buildings instead of 4 stories? Probably. They also state that Phase I is “sold out”….not really true though since they still have 1 Ardeen and 2 (huge) Laraghs left (typical developer speak I suppose).

Now…how is Oak Hill doing? I would suspect more downward pricing pressure there as a buyer would compare a cheaper much older Oak Hill condo with a bit more expensive Ivy Quad Clare flat.

Bear with me – an update is coming soon as part of a revival of this blog. Until then, here is the long term graph: http://bit.ly/SB-MLS-Nov-2010

Thanks Nick!!!

The October and November numbers are worse than expected. With November 2010 sales as bad as November 2008 and 2010 July, August, September, October and November worse than 2009, the real estate depression continues…

I would suspect that cash buyers have bought up a lot of the cheap inventory for investment purposes for rentals including Section 8 rentals (somehow catering to govt welfare residents as “the” real estate investment to make is a very bad (and sad) sign).

I would also suspect that the high end $500K+ and absolutely the $1M+ home prices in Michiana are getting crushed as the pool of potential buyer is almost nil for our area. New high end construction, including in Granger, will be countable on one’s fingers and toes as new construction prices will far exceed existing high end home prices.

Prediction (for Michiana area)…..2011 will trend 2009 sales throughout the year with some months sales below (especially at the beginning of the year) and a few above. If the 2011 average is below 2009 then we’re going to see a lot more real estate related businesses and investors throw in the towel as all hope will be lost.

Which builders (and their “warranties”) will go belly up in 2011?

I think the economic writing is on the wall….if I were mayor, I’d exit stage right too as things aren’t gonna turn around anytime soon no matter what city govt does. Prepare accordingly. In this economy, those with the least debt win.

I took a look at Ivy Quad again. As previously stated, I really like the brick and stone work….it is great. Whoever is the architect, he/she is very good, creative and attentive to details.

The Phase II “Clares” (“ClareII”) are NOT the same as the Phase I “Clares” (“Clare”)…….they really should have come up with a new name for this all new floorplan since the ClareII is 50% larger than the Clare. The ClareII is a MUCH better floorplan but still suffers from tandem parking and a lot of stairs in a very dense development. The ClareII will compete with Irish Crossings which is about wrapped up….the Irish Crossings’ floorplans, parking, and density is superior but if the ClareII reaches a substantially lower price point than Irish Crossings, it will compete….it is a trade off.

The economics of Ivy Quad is interesting…..they overpaid for the land (during the bubble) and so had to really up the density which means a lot more units to sell.

In order to compare total s.f., let’s assign Clare a 2, ClareII a 3, Ardeen a 4 and Laragh a 8. That’s roughly how they compare s.f. wise.

Phase I has a total of 78, Phase II 54, and Phase III 54 for a total of 186.

Assuming the model units are SOLD (big assumption), then Phase I still has 20 (2 Laraghs and 1 Ardeen) of 78 left or 25.6% of s.f. left to sell. That isn’t good economics to carry these units forward (and the tough ones to sell too).

Overall, Phase I has 20, Phase II 54, and Phase III 54 or 128 of 186 or 68.8% of s.f. UNSOLD. Not good.

Combine that with the cost of the land and the high cost of putting in all the development costs for the entire project upfront (unlike subdivisions where it is done in phases), can this project get done? Economically, it doesn’t look positive. Then add competition from other developments including (ND) Eddy Street Commons which offers a variety of price points and the stagnant (and lowering price points) of the old Oak Hill and Jamison Residences can Ivy Quad sell out their new ClareII floorplans in an attempt to hit the sweet spot??? Obviously you don’t make such radical changes if you had the secret recipe already…will be interesting and I hope it can be completed as it is very nice looking.

Drum roll………and the 2010 closing (December) sales number is???????

Ha! How timely… I’m working on a post now. I had it ready to go yesterday but a new sale was just entered today that is significant enough to rework all my graphs for. After finishing our winter rehab, I’m planning to put more time into the blog and post more frequently so check back often. The December 2010 sales figures were: 184 sales for $21.03 million in volume